- Home

-

Membership

- My AAA

- Benefits

- Other Products

-

AAA Members Save Big

-

Exclusive tickets and savings on theme parks, movies, concerts, sporting events and more.

- Buy Tickets

Join:(800) JOIN-AAA / (800) 564-6222

-

Travel

- Book Online

- Travel Essentials

- Book With an Advisor

-

Cruise Deals under $600

-

Escape the everyday and set sail for under $600 per person.

- Find Your Next Cruise

Need help booking? (800) 222-7448

-

Insurance

- Vehicle

- Home

- Life

- Other Products & Services

-

Quick Quote

Insurance Sales: (866) 222-7871

Insurance Customer Service:(800) 222-4242

-

Discounts

- Entertainment

- Automotive

- Shopping

- Travel

-

Ticket Discounts

-

Movie Tickets • Broadway Shows • Sporting Events • Concerts • ...and so much more!

- Buy Tickets

Membership has its privileges® VIEW DEALS -

Automotive

- Automotive Services

- DMV/RMV Services & EZ Pass

- Safety & Info

- Other Services

-

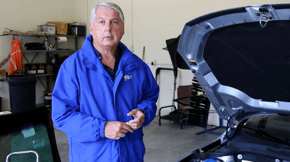

Meet AAA's Car Doctor!

-

John has evaluated more than 1,000 new cars and was an early adopter of electric vehicles, at one time owning a Renault Lectric Leopard.

- Ask a Question!

-

Roadside Assistance:(800) AAA-HELP / (800) 222-4357

-

Loans & Banking

- Auto Loans

- Student Loans

- Home Loans

- Other Products

-

Protect Your Identity

-

AAA Members get FREE access to ProtectMyID® from Experian®.

- Enroll Today

Financial Services:(800) 793-0508

-

News & Safety

- Defensive Driving / Point Reduction Courses

- Traffic Safety

- Public Affairs

- Media

- Defensive Driver

-

Driving Programs

- New Students

- Existing Students

- Defensive Driving Courses

-

Defensive Driving Courses

-

Licensed drivers can sharpen their skills and, in some states, save money on auto insurance and reduce license points with our online, virtual or in-person courses.

- Learn More

To speak with a Driving School Representative, call(855) 222-1050

- Home

- Membership

- Travel

- Insurance

- Discounts

- Automotive

- Loans & Banking

- News & Safety

- Driving Programs

- Roadside Assistance

- Find a Location

AAA Student Lending

-

Pivotal College Years

College Planning Portal for Families, with custom plans before, during & after college. -

College Ave Refinance Loans

AAA Northeast has partnered with College Ave to help members refinance a single student loan or consolidate multiple loans into one.

Schedule a call or speak with a AAA Student Lending specialist today! (888)422-2536